In accordance with the provisions set forth under Utah State law, the Assessor’s Office is required to verify and correctly classify all residential properties as a primary or secondary residence. State code 59-2-103 allows for a 45% residential exemption on primary residences in Utah. This means those receiving the exemption only pay property tax on 55% of the home’s fair market value.

What qualifies a home as a primary residence in Utah?

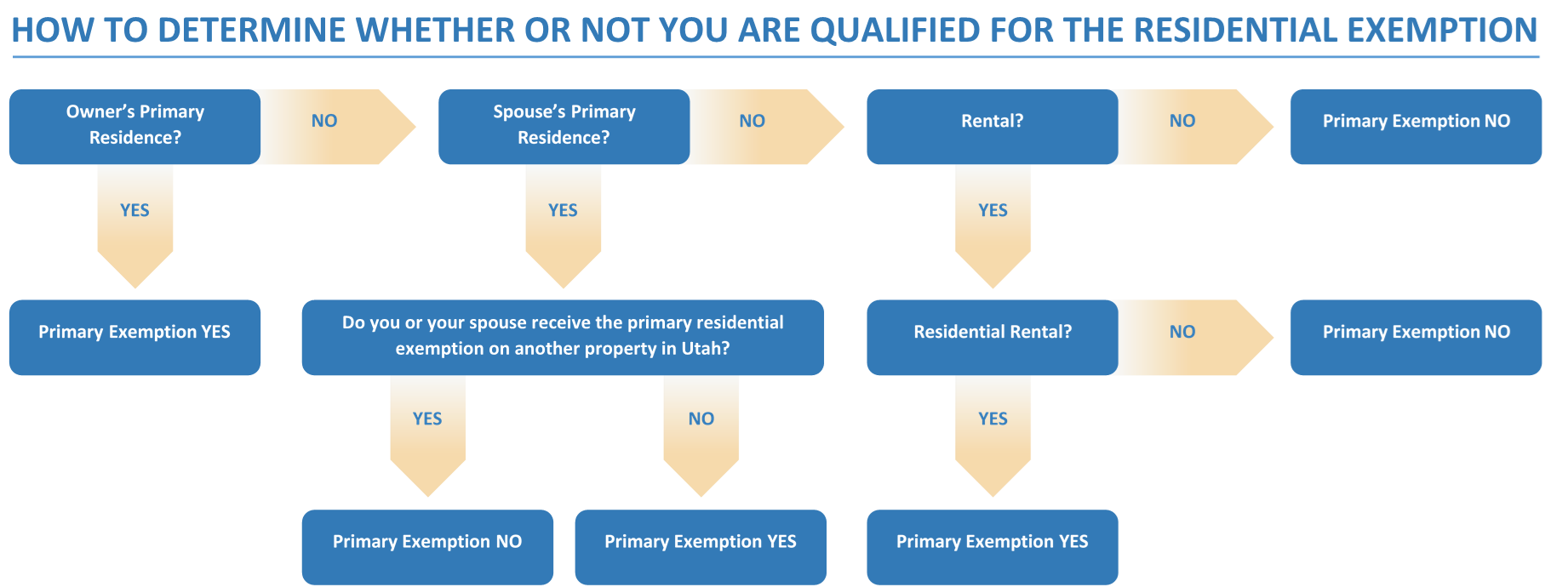

Utah code defines a primary residence as a home that serves as the occupant’s primary domicile for at least 183 consecutive days in a year. The owner, the owner’s spouse, another family member, or a tenant may occupy the residence. A household may only claim one residential exemption in the State of Utah.

Please note: If a property owner or owner’s spouse claims a residential exemption for property in Utah, that is the primary residence of the property owner or the owner’s spouse, that claim of a residential exemption creates a rebuttable presumption that you are domiciled in Utah for income tax purposes. Simply, your worldwide income may be subject to Utah State income tax, unless established otherwise. This would primarily impact individuals who live out of state but claim their primary residence is in Utah. Individuals in such circumstances or believe they could be affected may wish to seek advice from an income tax professional.

What if a home qualifies for the residential exemption but is not receiving it?

If a qualifying property is not currently receiving the exemption, the owner will need to make application with the County Assessor. When applying for the primary residential exemption, you will be required to submit one of the following documents containing the physical address of the property in question as evidence:

- Driver’s License (best option)

- Voter Registration Card

- Tax Returns

If the property in question is a rental, you will be required to submit a copy of the:

- Rental Agreement

Who is required to sign the residential property declaration?

All property owners must sign. This includes both spouses if the property is jointly owned by a married couple.

Definitions

A “household” means the association of individuals who live in the same dwelling, sharing its furnishings, facilities, accommodations, and expenses and includes married individuals, who are not legally separated, that have established domiciles at separate locations within the state. A household will only qualify for one residential exemption on an owner-occupied residence in Utah.

A “tenant” is a person who is not the owner, who occupies a property for at least 183 consecutive days per calendar year.

Frequently Asked Questions?

What is the primary residential exemption?Most homeowners in Utah receive a 45% exemption from property tax on their home (primary residence). A primary residence is defined as a home that serves as someone’s primary domicile and is occupied for at least 183 consecutive days in a year. An owner of multiple primary residences within the state is allowed a residential exemption for the primary residence of the owner and each residential property that is the primary residence of a tenant.

Who is required to sign the residential property declaration?

All property owners must sign. This includes both spouses if the property is jointly owned by a married couple.

The home is occupied by a tenant; does it qualify for the primary residential exemption?

A residential property is considered a primary residence if it is occupied for 183 or more consecutive calendar days in a calendar year. Nightly and short-term rentals do not qualify.

I own multiple residences in the state of Utah. How is the primary residential exemption applied?

Only one (1) exemption may be claimed per household within the state of Utah. This means if you own multiple residential properties in the state, they must be the primary residence of a tenant to receive the exemption. Vacation rentals, summer homes, recreational cabins, or second homes do not qualify for the exemption.

What happens if I do not return this form to the Weber County Assessor’s Office?

As per Utah law, Weber County will remove the exemption if you fail to return the completed form within 30 days from the date of notice. It is in your best interest to submit this declaration online or return the documents received in the mail, as these options do not require any supporting documentation. In the event the primary residential exemption is removed, you will have the opportunity to reapply by submitting a new application to the Weber County Assessor's Office. You will be required to submit additional evidence with your application. Evidence will include copies of your driver’s license, voter registration card, utility bills, and/or rental agreement.

Customer Service

If you need assistance, please call (801) 399-8572 or visit our office at 2380 Washington Blvd. Suite 380, Ogden, Utah 84401. Our office hours are Monday through Friday, 8 a.m. to 5 p.m.