Frequently Asked Questions

Frequently asked questions for Qualified Real Property Owners

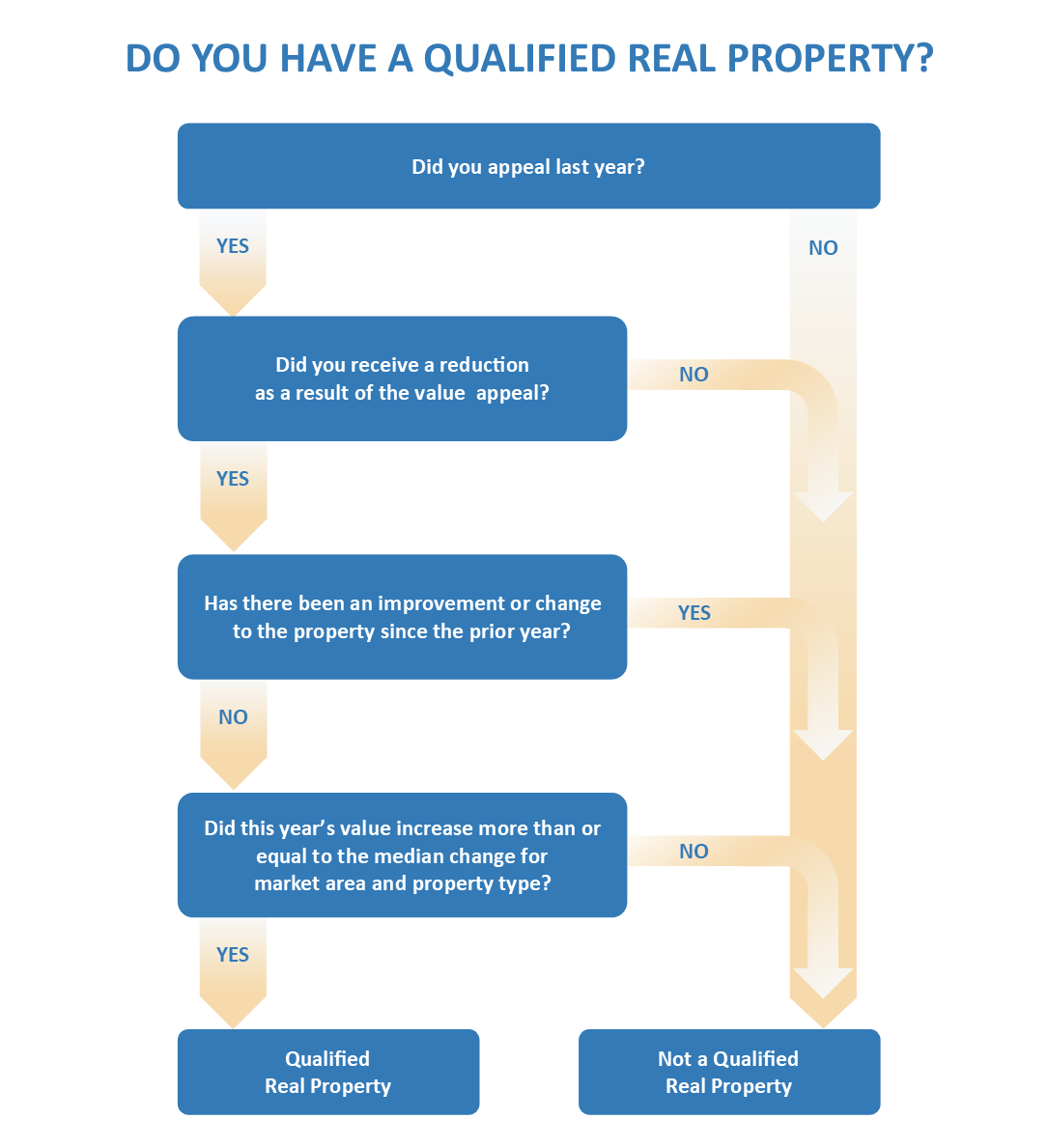

What is a “qualified real property”?A qualified real property is real property subject to appeal in the current year and:

- Was appealed in the previous year and had its value lowered; and

- Was NOT improved (e.g. renovations, additions) in the previous year.

What happens if my appeal involves a qualified real property?

The county Auditor will ask the county Assessor to determine the “inflation adjusted value”. Depending on what value is asserted by either the taxpayer or the county Assessor, the burden of proof may change.

What is the inflation adjusted value?

The county Assessor will look at the “median property value change” for real property in the same class and market area as your property (e.g. if the property is a residence, it may be the other homes in your neighborhood or town). This is a percentage that will be applied to the “final assessed value” to arrive at the inflation adjusted value.

What is the final assessed value?

This is the amount your value was lowered to in last year’s appeal. So, the median property value change (for your class of property in your market area) plus the final assessed value is the inflation adjusted value.

What effect will the inflation adjusted value have on the burden of proof in my appeal?

The inflation adjusted value will be considered the most correct value by the county Board of Equalization (BOE), and the county Assessor must prove their assertion of fair market value if they believe the property is equal to or greater than the inflation adjusted value.

What happens if I believe my value is below the inflation adjusted value?

The inflation adjusted value will be considered the most correct value by the county Board of Equalization (BOE), and the county Assessor must prove their assertion of fair market value if they believe the property is equal to or greater than the inflation adjusted value.

If I agree with the inflation adjusted value (and the county Assessor believes the value should be higher), will this change how I should prepare for my appeal?

NO. In a valuation appeal, both parties are arguing an opinion of value. Even if the inflation adjusted value is presumed most correct, the county BOE may agree with the county Assessor, or determine a third value based on evidence presented by both parties.

What if my property is NOT a qualified real property?

The burden of proof functions normally. You carry the burden of proof unless the county Assessor asserts a value higher than the one they originally assessed.

What if I have further questions?

As well as the county, you may contact Alex at the Property Tax Division at the Utah State Tax Commission on (801) 297-3631.

IT IS IMPORTANT BOTH PARTIES COME FULLY PREPARED TO ARGUE THEIR OPINION OF VALUE, REGARDLESS OF WHO CARRIES THE BURDEN OF PROOF.

THE COUNTY BOE WILL BE FREE TO CONSIDER ALL EVIDENCE AVAILABLE TO THEM, EVEN IF THE INFLATION ADJUSTED VALUE IS PRESUMED MOST CORRECT.

THE PARTY ARGUING AGAINST THE INFLATION ADJUSTED VALUE MAY BE SUBJECT TO GREATER SCRUTINY BY THE COUNTY BOE.