Quick Tips for Filing Online

In an effort to reduce costs, streamline government, and expand our commitment to customer service, the Weber County Assessor's Office is pleased to offer an online filing and payment option for Personal Property Tax returns. We have partnered with Forte Payments to securely process your online payments.

Please understand when you submit your filing and payment information online, it will not be possible for the Assessor's Office, the Bank, or Credit Card Company to stop the transmission of payment information.

Payments are considered to be made at the time the transaction is confirmed by the Forte Payments website and a confirmation number is issued. The confirmation page generated by Forte Payments when you submit your payment will show the date and time the payment was received by Weber County. Receipts dated after the due date will be considered delinquent. Weber County will not be responsible for any transmission delays that may cause your return and payment to be delinquent.

At the end of the filing process, you will be given the option to Print Return. Please print and retain a copy of your return for your records.

Should your return need corrections, the County Assessor will contact you accordingly.

Credit Card: We accept: Visa, MasterCard, Discover Card, and American Express. Your credit card account will be charged a fee of 2.5% of the amount of your payment ($2.00 minimum). In order to reduce the need to raise tax rates, the processing fees will be paid directly by the taxpayer. Approximately 2.0% of the fee is retained by your credit card company and the remaining 0.5% percent is retained by Forte Payments. Weber County does not receive any of this fee.

Debit Card: We accept: Visa, MasterCard, Discover Card, and American Express. Your credit card account will be charged a fee of 2.5% of the amount of your payment ($2.00 minimum). In order to reduce the need to raise tax rates, the processing fees will be paid directly by the taxpayer. Approximately 2.0% of the fee is retained by your credit card company and the remaining 0.5% percent is retained by Forte Payments. Weber County does not receive any of this fee.

Electronic Check: Electronic checks are processed from your checking or savings account. No fee will be charged to process tax payment using your checking or savings account.

If you have a large number of additions (35 line items or more), you can send a spreadsheet to the Assessor's Office to be uploaded to your account. Please call (801) 399-8572 for instructions.

When entering the acquisition cost of your equipment, be sure to round to the nearest dollar, no decimals.

Example: If the cost is 24.56, enter 25.

If you have leased equipment at your business location, you will need to have a copy of your lease agreement(s) available when filing online.

Computer equipment failure or transmission difficulties due to heavy traffic can and do occur. If you wait until the last minute to file and pay, our systems may be overwhelmed. Be wise and do not wait until the last day to file and pay. Weber County will not be responsible for any transmission delays that may cause your return and payment to be delinquent. If you have any questions, please call our office at 801-399-8572.

If you need assistance, please call (801) 399-8572 or visit our office at 2380 Washington Blvd. Suite 380, Ogden, Utah 84401. Our office hours are Monday through Friday, 8 a.m. to 5 p.m.

NEW FOR 2026

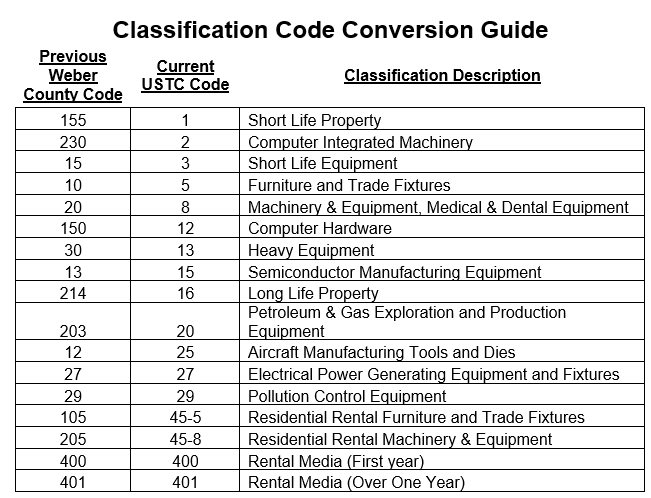

We are excited to announce a brand new look for the 2026 Business Personal Property Tax online filing system. This comes with innovative features like linking business accounts under a single user account, enhanced login security, and live viewing of accounts. We have also converted all classifications codes to be in line with that of the Utah State Tax Commission. All assets previously reported have been converted for you, see the conversion guide below for all changes.

Inconsequential Personal Property Exemption (59-2-1115): the taxable tangible personal property of a taxpayer is exempt from taxation if the taxable tangible personal property has a total aggregate market value per county of $30,100 or less for 2026.

Utah law states if a business files and qualifies for the personal property tax exemption, a county assessor may not require the business to file a business personal property signed statement for each continuing consecutive year for which the taxpayer qualifies for the exemption. Please note: If the total aggregate value of the personal property exceeds $30,100, the business is required to file. The Weber County Assessor's Office will notify you if your business has filed and qualified for the exemption.

- Consumable Spare Parts

- Plant and Equipment owned by Air Carrier

- Non-Licensed Vehicles

- Airport and Office Equipment

- (i) the purchase price of new or used items;

- (ii) the cost of freight, shipping, loading at origin, unloading at destination, crating, skidding, or any other applicable cost of shipping;

- (iii) the cost of installation, engineering, rigging, erection, or assembly, including foundations, piling, utility connections, or similar costs; and

- (iv) sales and use taxes.

Online Filing Information

- If your business closed in 2025, DO NOT file here. Please submit a: BUSINESS CHANGE FORM

- You will need the Account Number, PIN, and email address found on the Business Personal Property Online Tax Filing Notice received from the Assessor’s Office.

- Please call 801-399-8572 if you have any technical problems.

- Please Note – If you have leased equipment at your business location, you will need to have a copy of your lease agreement(s) available when filing online.